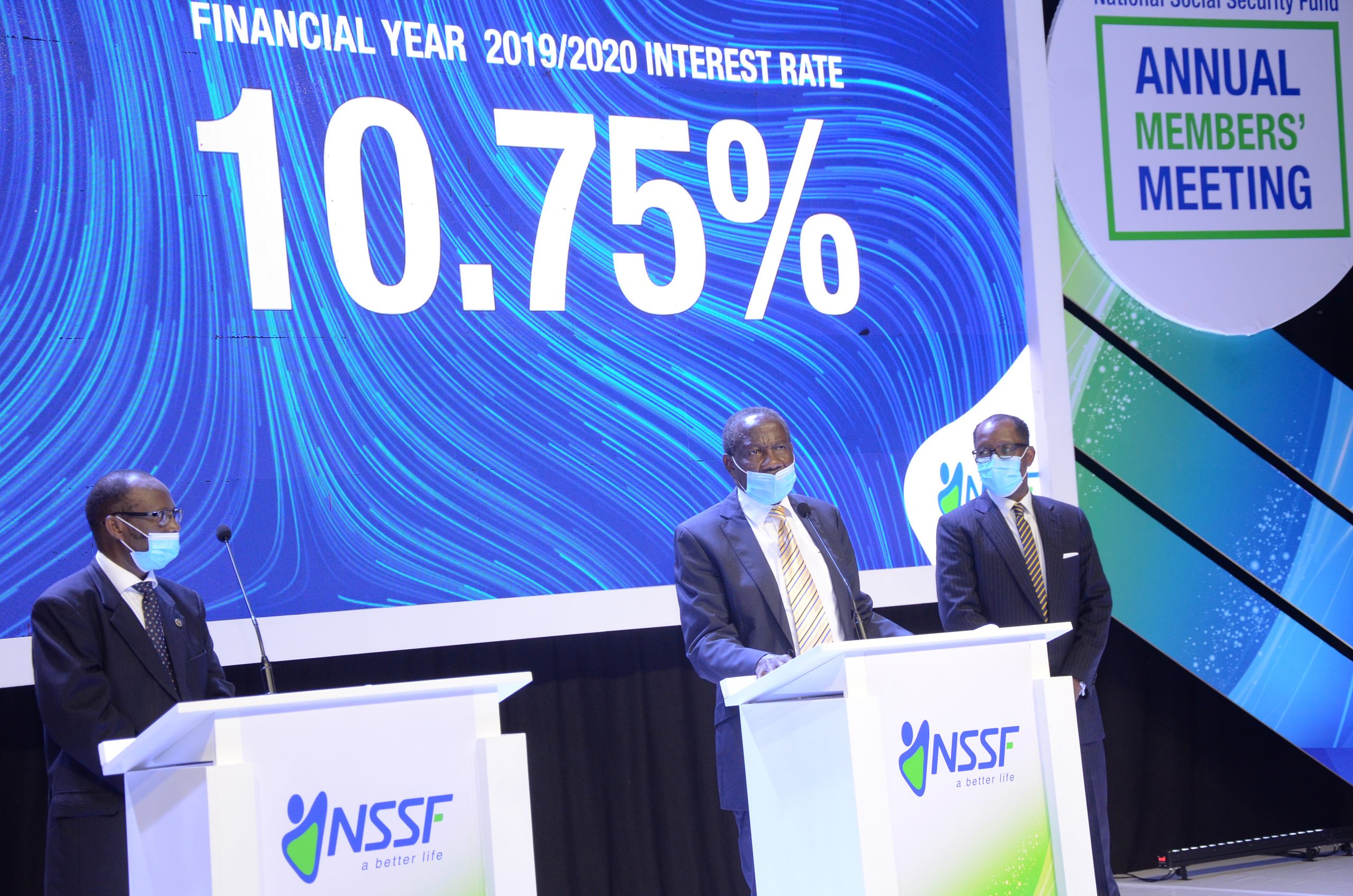

Finance Minister Matia Kasaija says his hopes now in the legislature to speed up the passing of the NSSF amendment Bill allowing for midterm access by members of the fund by at least this week. He admits that the bill if successfully passed would provide a window for additional benefits and expansion of the county’s savings threshold. The Minister was speaking at a virtual NSSF 8th Annual members meeting held at the Serena conference centre on Monday. The 10.75 per cent interest rate is a few points lower than last year’s 11 per cent interest majorly due to the economic slowdown occasioned by the COVID-19 pandemic and deferment of dividend payments by Bank of Uganda, among other factors, that affected the Fund’s performance.

“Despite the COVID-19 pandemic that has affected the economy and many businesses, NSSF has remained resilient, meeting its annual business objectives especially in the areas of Assets Under Management that grew by 17 per cent from UGX11.3 trillion to UGX13.3trillion and the total revenue that increased by 17 per cent,” Hon Kasaija said upon declaring the interest rate.

“I would therefore like to congratulate the NSSF team upon delivering a remarkable performance in the 2019/2020 in spite of the challenging macro environment,” Kasaija added.

Richard Byarugaba, NSSF Managing Director, reechoed the Fund’s resilience in the tough operating environment. “Many businesses both locally and globally are either closing down or seeking solutions for survival rather than expansion. I am happy that the Fund has been able to absorb the shocks as evidenced from our performance.”

The NSSF Chairman, Board of Directors, Patrick Kaberenge reassured members that the Fund was still committed to preserving value for their savings. “Despite a tough investment environment characterized by a strong shilling and depressed equity markets, the return earned has remained stable,” he said.

The 10.75 per cent interest earned is above the 10 year average inflation rate of 5.82.